Little Known Questions About Car Insurance.

Wiki Article

Excitement About Health Insurance

Table of ContentsInsurance Things To Know Before You Get ThisThe 15-Second Trick For Car InsuranceNot known Details About Home Insurance The 10-Minute Rule for Car InsuranceMore About Life Insurance

Constantly consult your employer initially for available insurance coverage. If your company does not offer the kind of insurance policy you desire, obtain quotes from numerous insurance policy carriers. Those that offer coverage in numerous areas might offer some discounts if you acquire more than one sort of insurance coverage. While insurance coverage is pricey, not having it might be even more pricey.It seems like a pain when you do not need it, yet when you do require it, you're freakin' appreciative to have it there (travel insurance). It's everything about transferring the danger here. Without insurance, you might be one vehicle wreck, illness or emergency situation far from having a substantial money mess on your hands.

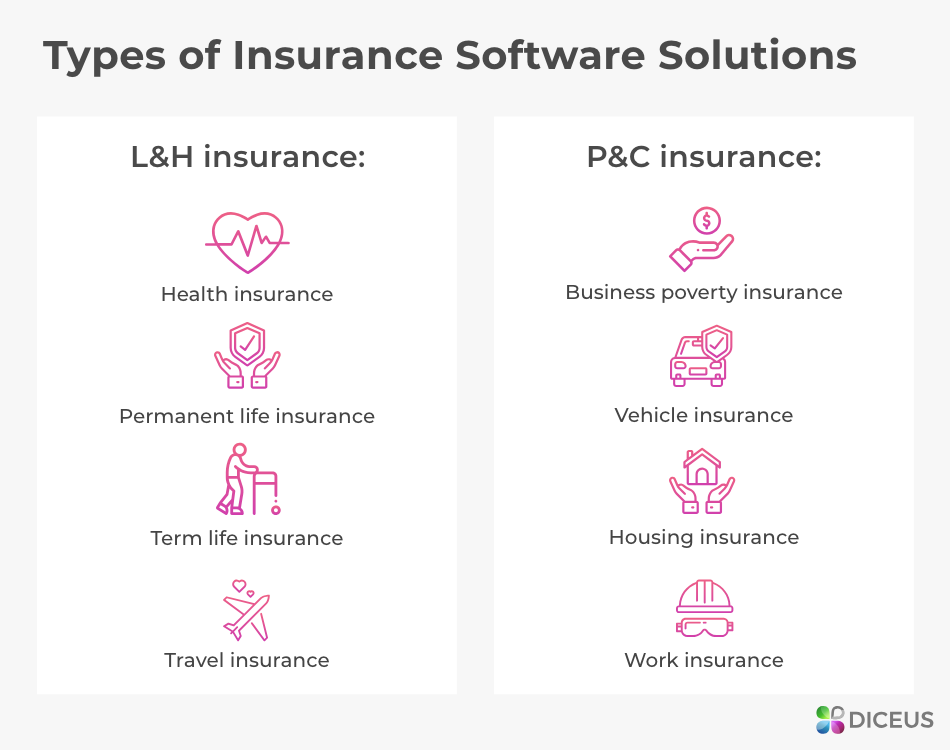

Uncertain what the distinction is in between every one of these? Have no fearwe'll damage down everything you require to learn about each of these types of insurance policy. 1. Term Life Insurance Policy If there's just one type of insurance policy that you enroll in after reviewing this, make it call life insurance policy.

The Definitive Guide to Home Insurance

Assume concerning this: The younger you are, the much more affordable term life insurance coverage is. All that to say, if it's something you believe you might use in the future, it's cheaper to get it currently than in 15 years.Vehicle Insurance policy You ought to never ever drive about uninsurednot even if it protests the legislation however likewise since getting in a minor car accident can be ex-pen-sive. The Insurance Info Institute claims the typical loss per claim on cars is around $1,057. Imagine needing to pay that sort of money out of pocket! Fortunately is, you have actually got options when it comes to automobile insurance coverage, so there's no factor to avoid it.

As well as flooding insurance policy is also different than water back-up protection. An agent can assist you make sense of it all. If you do not live anywhere near a body of water, this insurance isn't for you.

The Best Guide To Life Insurance

Bear in mind, if you don't have wind insurance policy coverage or a different typhoon insurance deductible, your home owners insurance coverage plan will not cover typhoon damages. Depending on where you reside in the nation, earthquake insurance coverage may not be included in your home owners insurance coverage. If you reside in a place where quakes are understood to shake things up, you could desire to tack it on your plan.Without occupants tricare west insurance coverage, it's up to you to change your possessions if they're shed in a fire, flooding, burglary or some various other calamity. Plus, a great deal of proprietors and also apartments will certainly need you to have tenants insurance also. A good independent insurance agent can stroll you with the steps of covering the basics of both homeowners as well as tenants insurance coverage.

Don't put on your own in that position by not having health and wellness insurance policy. The high price of clinical insurance policy isn't a justification to go without coverageeven if you do not go to the physician a whole lot. To aid reduce on the expense of medical insurance, you published here might get a high-deductible health and wellness insurance strategy.

You can spend the funds you contribute to your HSA, and also they grow tax-free for you to use now or in the future. You can use the cash tax-free on certified clinical costs like health insurance deductibles, vision and oral. Some business currently use high-deductible wellness plans with HSA accounts along with standard health and wellness insurance policy strategies.

The 25-Second Trick For Home Insurance

Insurance offers tranquility of mind versus the unexpected. You can find a policy to cover almost anything, but some are extra crucial than others. As you map out your future, these four types of insurance policy ought to be strongly on your radar. travel insurance.Some states likewise require you to lug individual injury security (PIP) and/or uninsured motorist protection. These insurance coverages pay for clinical expenditures associated to the event for you as well as your passengers, regardless of that is at fault. This additionally aids cover browse around this web-site hit-and-run mishaps and also crashes with drivers that don't have insurance policy.

However if you do not buy your very own, your loan provider can buy it for you and also send you the costs. This might come at a higher price and with much less coverage. Home insurance is an excellent idea even if you have actually paid off your home loan. That's because it shields you versus expenditures for home damage.

In the occasion of a theft, fire, or calamity, your occupant's policy should cover most of the costs. It may additionally aid you pay if you have to remain somewhere else while your residence is being fixed. And also, like residence insurance, renters provides obligation security.

See This Report on Renters Insurance

That method, you can keep your health as well as health to satisfy life's needs.Report this wiki page